2025 Onalaska School District Replacement Levy

On April 22, 2025, Onalaska School District is asking voters to consider a three-year replacement educational programs and operations (EP&O) levy to sustain quality educational opportunities for all Onalaska School District students. Our students deserve access to the same staffing and support that students in larger districts receive. If approved by voters, the levy would fund:

Extracurricular activities for active and engaged students

Health and counseling services for our students’ physical and mental well-being

Transportation for efficient and safe commutes

Technology and equipment for modern learning tools and resources

Music and enrichment programs for our students to explore their talents and passions

Special education for inclusive learning opportunities

Maintenance for welcoming and clean schools and facilities

Preschool for our youngest learners to grow and thrive

Security for safe and secure schools and environments

Your voice. Their education.

This is NOT a new tax.

Onalaska School District has continued to thrive from the opportunities created by the support from the community. This replacement EP&O levy is not a new tax. It replaces the current levy set to expire at the end of 2025.

What is the yearly breakdown?

The proposed three-year replacement levy will collect a total of $5.8 million from 2026–2028.

2026 proposed amount: $1,891,440

2027 proposed amount: $1,948,184

2028 proposed amount: $2,006,629

Tax Rates

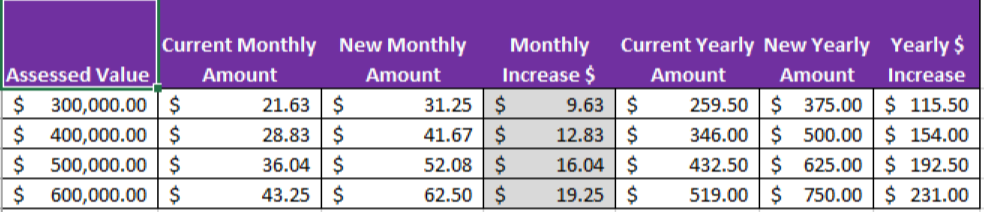

What will this cost?

The estimated rate for the replacement levy is $1.25 per $1,000 of assessed value.

For example, if you own property with an assessed value of:

$400,000 you’d pay $41.67 per month

$500,000 you’d pay $52.08 per month

$600,000 you’d pay $62.50 per month

Remember, this is a replacement levy. The calculation is the estimated total cost to property owners, not an additional tax.

Actual year-to-year levy rates will be based on the total assessed property value across Onalaska School District. We can only collect the total funds approved by voters. If property values rise, the rate per $1,000 of assessed property value will drop.

Did you know?

Our district’s assessed property values have consistently exceeded projections, resulting in the actual tax rate per $1,000 being lower than originally estimated each year.

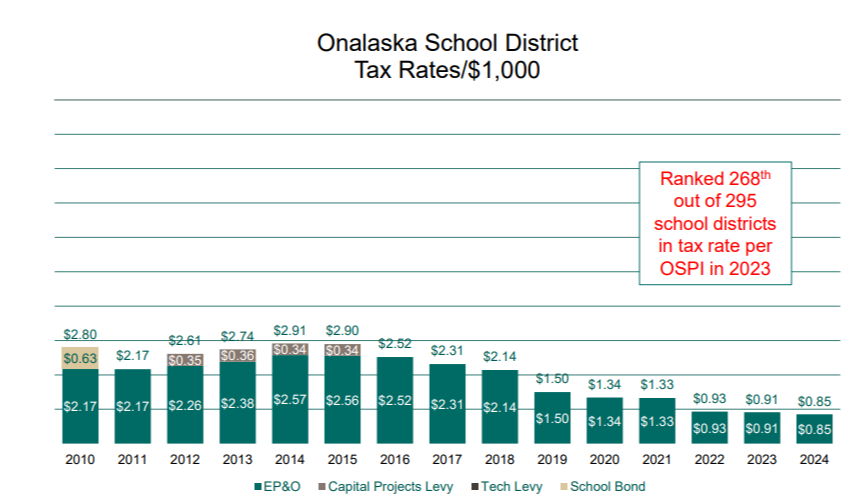

Onalaska tax levy rates are the 2nd lowest in Lewis County and ranked 268 out of 295 in the state when comparing tax rates.

How much more will this tax cost me?

Below is a representation of what our tax payers are currently paying, and can approximately expect to pay when the levy is renewed.

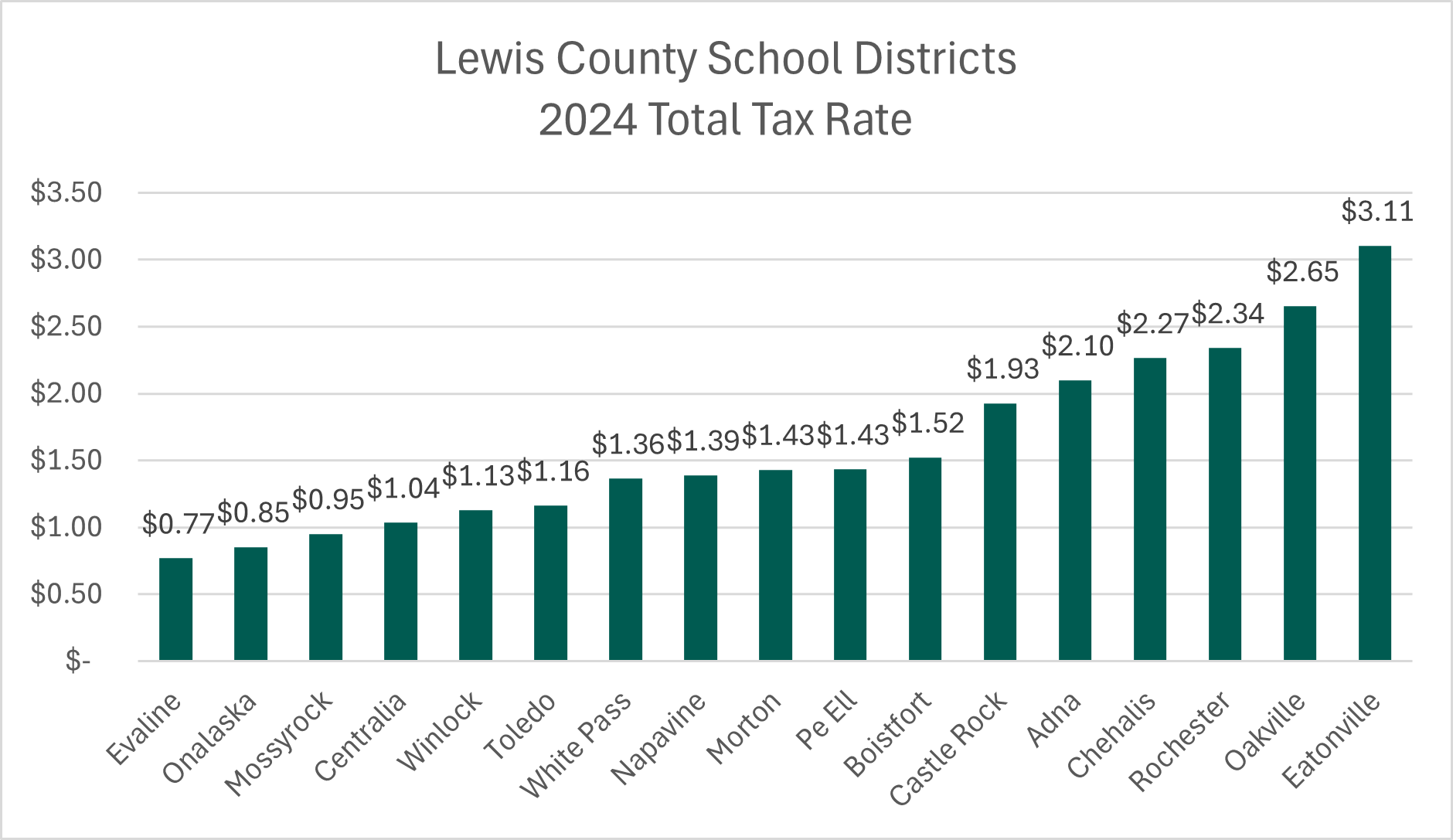

How do our rates compare to other districts in our county and state?

This chart shows how our total tax rate compares to other tax rates in the county. Our current tax rate is the 2nd lowest in the county.

This chart shows how our local tax rate has changed over the years and how it compares to other tax rates in the state. Our tax rate is ranked 268 out of 295 school districts .

School Funding Information

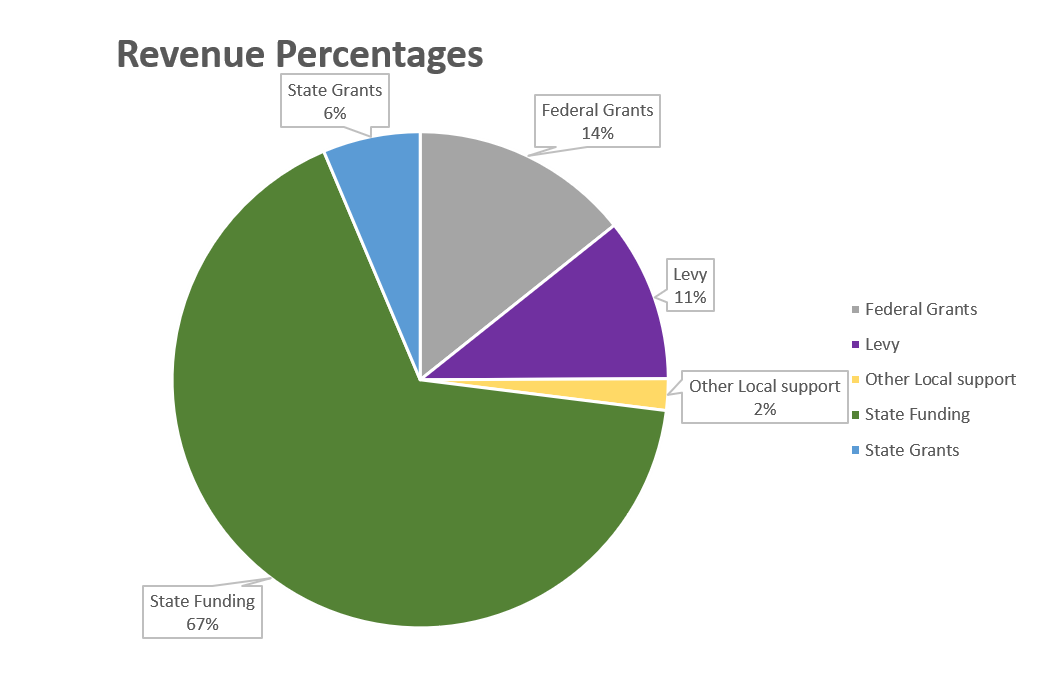

What are your current revenue streams? How will this money be spent?

Levy dollars make up 11% of our districts' revenue. This is crucial to fund things that are not funded or are underfunded by the state.

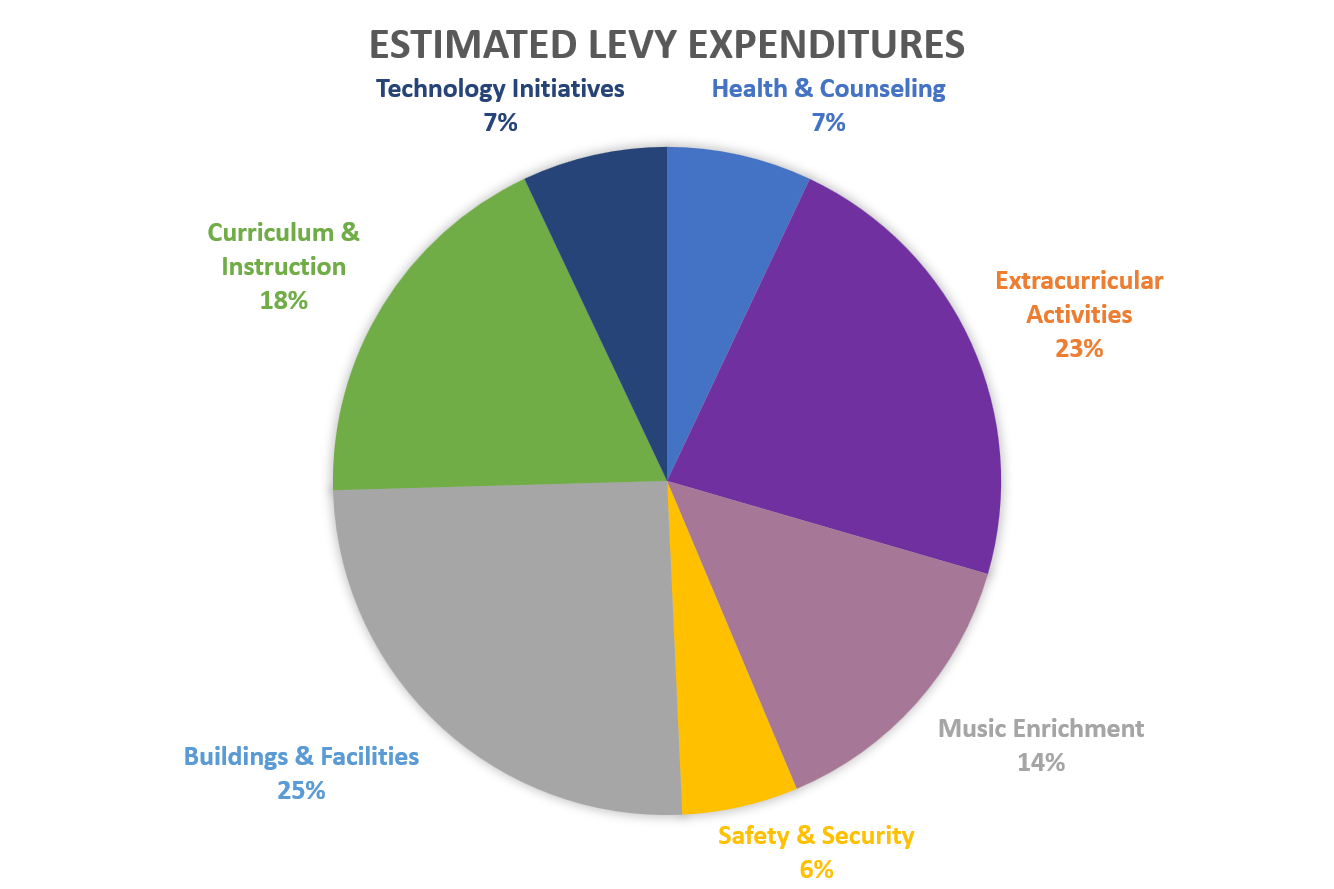

Levy dollars generate revenue to fund programs and services that are not covered under "basic education." For Onalaska School District, these dollars are used for the following:

Curriculum & Instruction : substitute costs, updated curriculum, STEAM opportunities, special education services, behavior supports, and additional FTE beyond what is funded in the prototypical school funding model.

Technology Initiatives: one to one Chromebook initiative, instructional technology in classrooms, updated network and technology staff beyond what is funded in the prototypical school funding model.

Health & Counseling: nursing staff, mental health and academic counseling supports, and health supplies beyond what is funded in the prototypical school funding model.

Extracurricular Activities: 100% funded by levy dollars including coaching staff, athletics supplies, facilities and transportation.

Music Enrichment: 100% funded by levy dollars, grants, and other local funding sources. Instructional staff, supplies and transportation.

Safety & Security: 100% funded by levy dollars and grants. Cameras, door hardware, school safety and security staff, and training for all our staff to best keep our students safe.

Buildings & Facilities: Staff, building maintenance and upgrades, and insurance and utility costs beyond what is funded by the school funding model.

How was this levy amount determined?

This levy amount was determined after taking into account collections in prior years that either remained static or did not increase enough to account for rising costs in underfunded areas. As well, the team examined levy tax rates across the state, and found that our tax rate was the 2nd lowest in our county and ranked 268 out of 295 in the state. District costs have increased in all areas. To name a few:

District Property Insurance costs have increased by over $215,000 since the last levy was approved.

The district was underfunded in utilities and insurance costs by $343,000 in 2023-2024.

From 2020/2021 when the last levy was set, the district went from receiving $265,000 in Local Effort Assistance (LEA) dollars to receiving $0 LEA in 2023/2024 based on our assessed values.

Get to know our District!

Frequently Asked Questions

Please vote by April 22, 2025.

Want more information? Call the District Office at 360-978-4111 or email bpadgett@onysd.wednet.edu.